As we all have been reading that Real Estate is going through a phase where there is lots happening, be it the Regulatory Body RERA getting implemented, impact of NBFC going down, reduction in Interest rates, to few developers going bust. All these things leave a normal consumer puzzled and they are unable to take a decision.

While all the above mentioned can be topic in itself for long discussion and debate, we would look at an option as an example and see if it makes sense to buy a property or not.

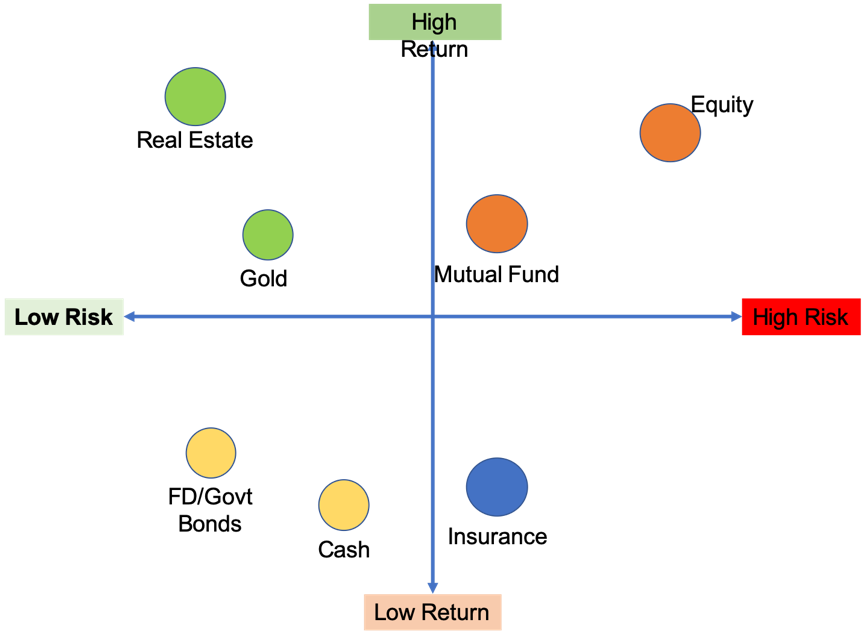

As a retail investor we have few set investment options that we can look at,

- Fix Deposit/Govt Bonds

- Mutual Funds

- Stocks/Equity

- Gold

- Real Estate

- Insurance Policies (Money Back Options)

- Liquid Cash in Bank

These can be further classified:

- Safe and low return

- Safe and good return

- Safe and high return

- Risky and low return

- Risky and high return

Generally, people tend to follow the trend looking at the friends and family and do exactly the same as what other they trust are doing.

However, every individual is different and has different needs and objectives of investment. There are many articles and talk which are there on who should invest where basis the needs and age profile, risk ability etc. But there are other factors as well as to how is one able to monitor the investment. Example: Young person has higher appetite of taking risk and can look at investment in stock market, though this is right but then if you are long term player and if you can find time to keep a track and act on time then this is good else you may end up losing money even on good company stocks. Also, its important to do a lot of research before you invest your money in the market. In today’s scenario individuals are so occupied in their own jobs that they hardly get time to spend with family and friends where will they make time to do the research and keep track regularly.

Also, as a young investor you also will not understand the market if you don’t have fair knowledge on finance and how market works.

Another interesting investment option of buying real estate in India has never been on the list of young people. Its always perceived that you buy your first home to stay and investment is always a second home. That means the first real estate purchase is going to be one of the biggest purchases you have ever done till date, so it is never on the list as young investor. However, there is another thought on this, we can make an investment in real estate at the upcoming location which is going to take some time in development and the time horizon depends on the length of investment that one is looking at. So, you invest at a lower rate as the area which is going to develop as per the development plan. There are many projects that are like these where initial investment is low and can even be looked as an option by the people in their early years of job. To give you an example Talegaon which has so many things coming up in near future and has already established MIDC, Schools, Colleges etc. has projects which gives good investment options stating as low as Rs.15 lacs, and they also have facility like assistance in renting etc. which looks like a great opportunity as an investor as you don’t need to worry about maintaining and renting the property even after possession. Historically property prices have given great returns, even in last few years the prices have not gone up like before but at the same time it has not gone down. So at least my principle is secured, and rent will be my return apart from the rate appreciation over a period of time. Also, later when one wants to purchase a house to self-use they can sell this and pay the own contribution as down payment and reduce the loan amount to great extent.

It is never a bad time to buy a property if you have done your homework well. And it’s easy to buy a home with an EMI as low as 9-10K per month to own a house as a youngster.

There are many who will debate on this and everyone will have a point of view, and yes, the point of view if from the fact that how an individual is looking at the end objective with the current resources that they have.

For example, if we invest the same amount of money in Gold and Apartment which will be more secure and fruitful in longer run. So, if we take historic data and see the appreciation of both then both these asset class have given great results to the people who have invested so decent time. But then are both equally good. These can be evaluated on multiple parameters:

- Liquidity: In case of need Gold has more liquid asset as compared to Real Estate

- Returns: In terms of returns Real Estate wins over Gold as while both have appreciated considerably but if you had an apartment then if can get you rental income along with appreciation which Gold can not

- Maintenance: Both require to be maintained, Gold in locker attract locker fee etc. and so does the apartment which has maintenance charges, property tax etc. so if your earnings are higher than spends then the decision becomes easy as to which investment is better for the individual

Lets put the investments in the grid where we have 2 parameters of Risk and Returns mapped.